When researching retirement savings options, gold IRAs often emerge as attractive alternatives. Both offer the promise of portfolio stability, but each comes with {uniquestrengths and considerations.

A Gold IRA is a retirement account that permits you to allocate in gold bullion. On the other hand, owning gold bars and coins involves physically owning the asset.

- Considerations like your investment goals, tax implications, and access requirements all play a significant role in determining the best choice.

Consulting a more info reputable expert can provide valuable insights to help you make an informed decision that aligns your individual circumstances.

Gold IRA vs. 401(k): Which Reigns Supreme?

Deciding amongst the allure of a traditional retirement account like a 401(k) and the potential of a Gold IRA can feel daunting. Neither option offers unique advantages, making it crucial to carefully weigh your investment goals. A 401(k) typically entails investments made from pre-tax income, usually offering income benefits. On the other hand, a Gold IRA allows you to manage your portfolio with physical gold, potentially protecting against market volatility.

- Think about your risk appetite.

- Research the fees associated with each option.

- Consult with a financial advisor to design a plan that fulfills your individual needs.

In conclusion, the best choice for you will depend on your situation. Diligent planning and analysis are essential to making an informed decision.

Investing in a Gold IRA?

Deciding whether/if/if perhaps to invest in/add to/include a Gold IRA can be a complex/difficult/tricky decision/choice/call. On the positive/upside/beneficial side, gold is considered/seen as/viewed by many a safe haven/reliable investment/stable asset during periods of economic uncertainty/market volatility/financial instability. It also has the potential to hedge against inflation/protect your savings/preserve your wealth over time. However, there are also potential drawbacks/considerations/risks to keep in mind/be aware of/factor into your decision. Gold IRAs can have higher fees/greater costs/more expenses than traditional/standard/conventional IRAs, and the value of gold can fluctuate significantly/wildly/drastically, meaning you could lose money.

- It's essential to/You should always/Make sure to carefully research/thoroughly examine/meticulously investigate all aspects of a Gold IRA before making a decision/committing your funds/investing.

- Consulting with/Speaking to/Seeking advice from a qualified financial advisor can be helpful/beneficial/advisable in determining/figuring out/assessing if a Gold IRA is the right choice/option/fit for your individual financial goals/investment objectives/retirement plans.

Gold IRAs: Find the Perfect Fit for Your Portfolio

Securing your financial future demands careful consideration of diverse portfolio strategies. A gold IRA presents a compelling option for investors seeking to hedge against their existing assets.

However, navigating the multifaceted world of gold IRAs can be challenging without a reliable understanding of key considerations. This resource aims to shed light on top-rated gold IRA providers, empowering you to make an informed selection that suits your specific financial goals.

- Consider the provider's standing in the industry.

- Compare fees and expenses carefully.

- Explore the selection of gold products offered.

By performing thorough due diligence, you can securely select a precious metals custodian that meets your requirements.

Unleashing the Potential of a Gold IRA Investment

A Gold Individual Retirement Account (IRA) presents a valuable investment opportunity for those seeking to hedge their portfolios against financial uncertainty. By allocating a portion of your retirement savings to precious metals like gold, you can significantly reduce your overall vulnerability. Gold has historically served as a reliable store of value during periods of inflation, making it an appealing addition to a well-rounded retirement plan. Moreover, the tax advantages associated with IRAs can maximize the long-term performance of your gold investment.

- Evaluate factors such as current market conditions, financial situation, and professional advice before making any allocations regarding your Gold IRA.

- Work with a reputable financial advisor who has extensive knowledge of gold investments and retirement planning strategies.

Is Gold IRA Worth It? Exploring the Benefits and Risks

A Gold Individual Retirement Account presents a compelling possibility for investors seeking to protect their portfolios. Gold, as a precious asset, commonly serves as a safeguard against inflation and economic uncertainty. A Gold IRA allows you to own physical gold within a tax-advantaged retirement account.

Nonetheless, it's crucial to carefully consider both the benefits and risks before investing in a Gold IRA.

- The primary benefit is the chance for appreciation in value over time, as gold has a history of functioning well during periods of economic instability

- Additionally, Gold IRAs can deliver a degree of variation to your retirement portfolio, reducing overall risk.

Conversely, there are specific risks associated with Gold IRAs. For instance , gold prices can be fluctuating, meaning your investment value could decline.

- Additionally, There are likely costs associated with setting up and maintaining a Gold IRA, which can impact your overall returns.

- Lastly, It's essential to work with a reputable financial advisor to determine if a Gold IRA is the right approach for your individual needs and aspirations.

Shane West Then & Now!

Shane West Then & Now! Bernadette Peters Then & Now!

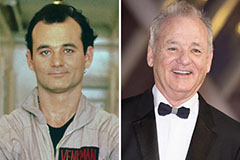

Bernadette Peters Then & Now! Bill Murray Then & Now!

Bill Murray Then & Now! Morgan Fairchild Then & Now!

Morgan Fairchild Then & Now! Mike Smith Then & Now!

Mike Smith Then & Now!